Q4 2020 Western Washington Real Estate Market Update

The following analysis of the Western Washington real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact me!

REGIONAL ECONOMIC OVERVIEW

After the COVID-19-induced declines, employment levels in Western Washington continue to rebuild. Interestingly, the state re-benchmarked employment numbers, which showed that the region lost fewer jobs than originally reported. That said, regional employment is still 133,000 jobs lower than during the 2020 peak in February. The return of jobs will continue, but much depends on new COVID-19 infection rates and when the Governor can reopen sections of the economy that are still shut down. Unemployment levels also continue to improve. At the end of the quarter, the unemployment rate was a very respectable 5.5%, down from the peak rate of 16.6% in April. The rate varies across Western Washington, with a low of 4.3% in King County and a high of 9.6% in Grays Harbor County. My current forecast calls for employment levels to continue to improve as we move through the spring. More robust growth won’t happen until a vaccine becomes widely distributed, which is unlikely to happen before the summer.

WESTERN WASHINGTON HOME SALES

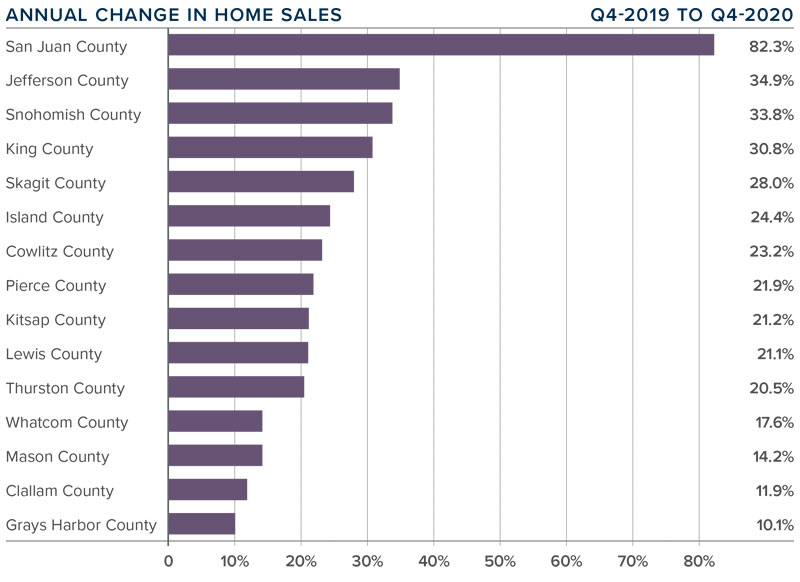

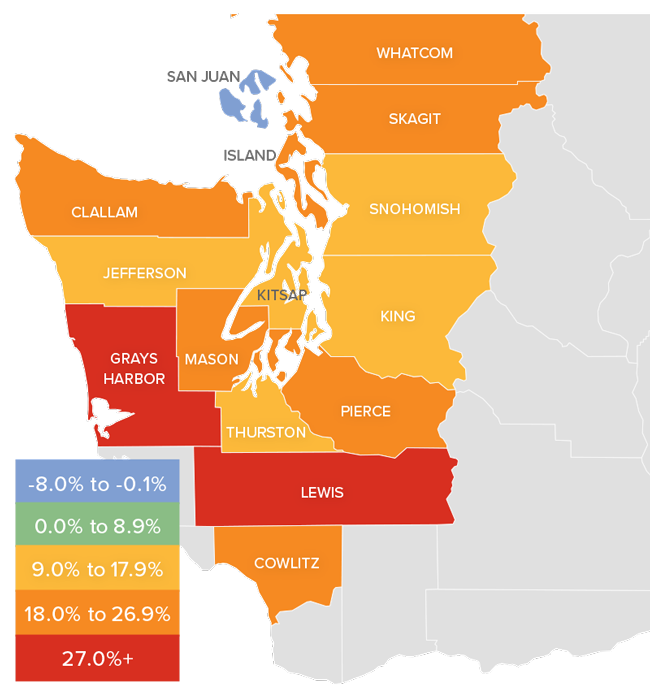

❱ Sales continued to impress, with 23,357 transactions in the quarter. This was an increase of 26.6% from the same period in 2019, but 8.3% lower than in the third quarter of last year, likely due to seasonality.

❱ Listing activity remained very low, even given seasonality. Total available inventory was 37.3% lower than a year ago and 31.2% lower than in the third quarter of 2020.

❱ Sales rose in all counties, with San Juan County seeing the greatest increase. This makes me wonder if buyers are actively looking in more remote markets given ongoing COVID-19 related concerns.

❱ Pending sales—a good gauge of future closings—were 25% higher than a year ago but down 31% compared to the third quarter of 2020. This is unsurprising, given limited inventory and seasonal factors.

WESTERN WASHINGTON HOME PRICES

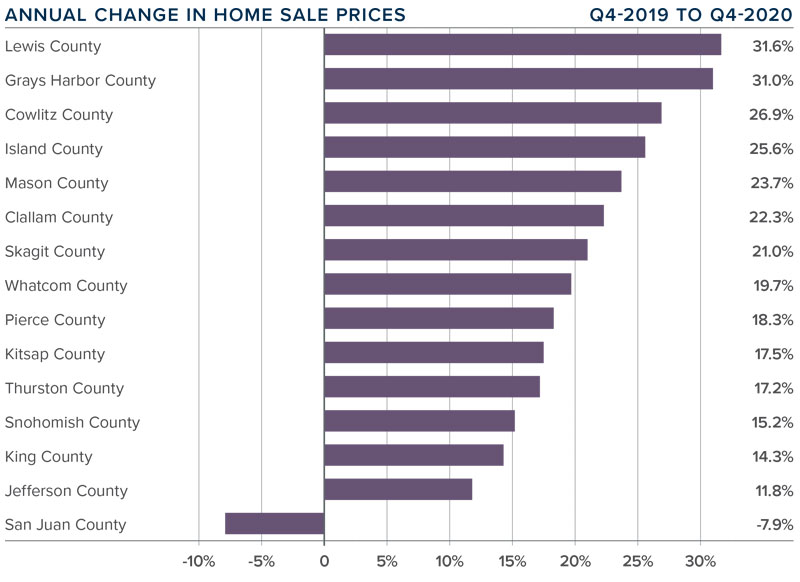

❱ Home price growth in Western Washington continued the trend of above-average appreciation. Prices were up 17.4% compared to a year ago, with an average sale price of $617,475.

❱ Year-over year price growth was strongest in Lewis and Grays Harbor counties. Home prices declined in San Juan County which is notoriously volatile because of its small size.

❱ It is interesting to note that home prices were only 1% higher than third quarter of 2020. Even as mortgage rates continued to drop during the quarter, price growth slowed, and we may well be hitting an affordability ceiling in some markets.

❱ Mortgage rates will stay competitive as we move through 2021, but I expect to see price growth moderate as we run into affordability issues, especially in the more expensive counties.

DAYS ON MARKET

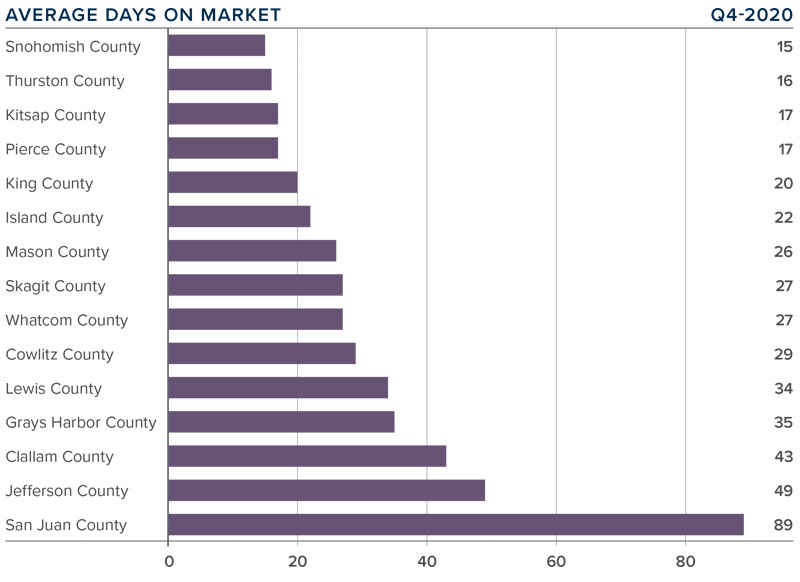

❱ 2020 ended with a flourish as the average number of days it took to sell a home in the final quarter dropped by a very significant 16 days compared to a year ago.

❱ Snohomish County was again the tightest market in Western Washington, with homes taking an average of only 15 days to sell. The only county that saw the length of time it took to sell a home rise compared to the same period a year ago was small Jefferson County, but it was only an increase of four days.

❱ Across the region, it took an average of 31 days to sell a home in the quarter. It is also worth noting that, even as we entered the winter months, it took an average of five fewer days to sell a home than in the third quarter of last year.

❱ The takeaway here is that demand clearly remains strong, and competition for the few homes available to buy continues to push days on market lower.

CONCLUSIONS

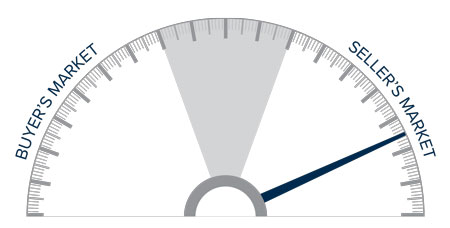

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Demand has clearly not been impacted by COVID-19, mortgage rates are still very favorable, and limited supply is causing the region’s housing market to remain incredibly active. Because of these conditions, I am moving the needle even further in favor of sellers.

2021 is likely to lead more homeowners to choose to move if they can work from home, which will continue to drive sales growth and should also lead to more inventory. That said, affordability concerns in markets close to Western Washington’s job centers, in combination with modestly rising mortgage rates, should slow the rapid home price appreciation we have seen for several years. I, for one, think that is a good thing.

ABOUT MATTHEW GARDNER

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

This post originally appeared on the Windermere.com Blog by Matthew Gardner

Local Market Update – January 2021

The end of 2020 marked a most unusual year, and the real estate market was no exception. While homes sales usually take a holiday during December, this year saw the continuation of an exceptionally strong and competitive market. New listings, closed sales and home prices all went up. With supply nowhere close to meeting demand, the strong market is expected to extend into 2021.

Inventory continues to be the biggest challenge for buyers. While King County had a 62% increase in new listings compared to a year ago, homes were snapped up quickly, leaving the county with just over two weeks of available inventory at the end of the month. The supply of single-family homes was down 35% year-over-year. Buyers considering a condo had far more choices. Inventory was up 45%, but at about five weeks of available units the condo market is still significantly short of the four month supply that is considered balanced. Inventory in Snohomish County was even more strained, with the month end showing only a one-week supply of homes. At the end of December there were only 373 homes on the market in all of Snohomish County, a 63% drop from a year ago. With inventory this tight, it’s more important than ever for buyers to work with their agent on a strategic plan for getting the home they want.

Low inventory and high demand continued to push prices upward. The median single-family home price in King County was up 10% over a year ago to $740,000. Price increases varied significantly by area. Seattle home prices were up 10%. The traditionally more affordable area of Southwest King County, which includes Federal Way and Burien, saw prices jump 15%. And on the Eastside, the most expensive market in King County, home prices soared 17% — the largest increase of any area in the county. Home prices in Snohomish County rose 12% to $573,495, just shy of its all-time high of $575,000.

With 2021 ushering in a new record low for interest rates, and inventory at its tightest in recent memory, 2021 is expected to remain a very competitive market.

Windermere Chief Economist Matthew Gardner’s prediction: “As we move into 2021, I expect continued strong demand from buyers, but unfortunately, the likelihood that there will be any significant increase in inventory is slim. As a result, I believe prices will continue to rise, which is good news for sellers, but raises concerns about affordability. This, combined with modestly rising mortgage rates, could end up taking some steam out of the market but overall, I expect housing to continue being a very bright spot in the Puget Sound economy.”

The charts below provide a brief overview of market activity. If you are interested in more information, every Monday Windermere Chief Economist Matthew Gardner provides an update regarding the impact of COVID-19 on the US economy and housing market. You can get Matthew’s latest update here.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com

Local Market Update – August 2020

While the pace of daily life may seem slow right now, the

local real estate market has had an unusually busy summer. The number of

new listings in July was up, sales increased, and home prices followed

suit.

• While overall inventory is at historic lows, more sellers put their homes on

the market. New listings of single-family homes in King County jumped more than

25% from a year ago. Snohomish County saw a 7% increase in new listings.

• Pent-up buyer demand fueled sales activity in July. The number of pending

sales was up 17% over a year ago in King County, and up 13% in Snohomish

County.

• With buyers snapping up new listings as soon as they hit the market, total

available inventory dropped to a 10-year low for the month.

• The lack of inventory is benefiting sellers, and multiple offers are now common

at every price point. As a result, single-family home prices rose 7% in King

County and 15% in Snohomish County.

The charts below provide a brief overview of market activity. If you are interested in more information, every Monday Windermere Chief Economist Matthew Gardner provides an update regarding the impact of COVID-19 on the US economy and housing market. You can get Matthew’s latest update here.

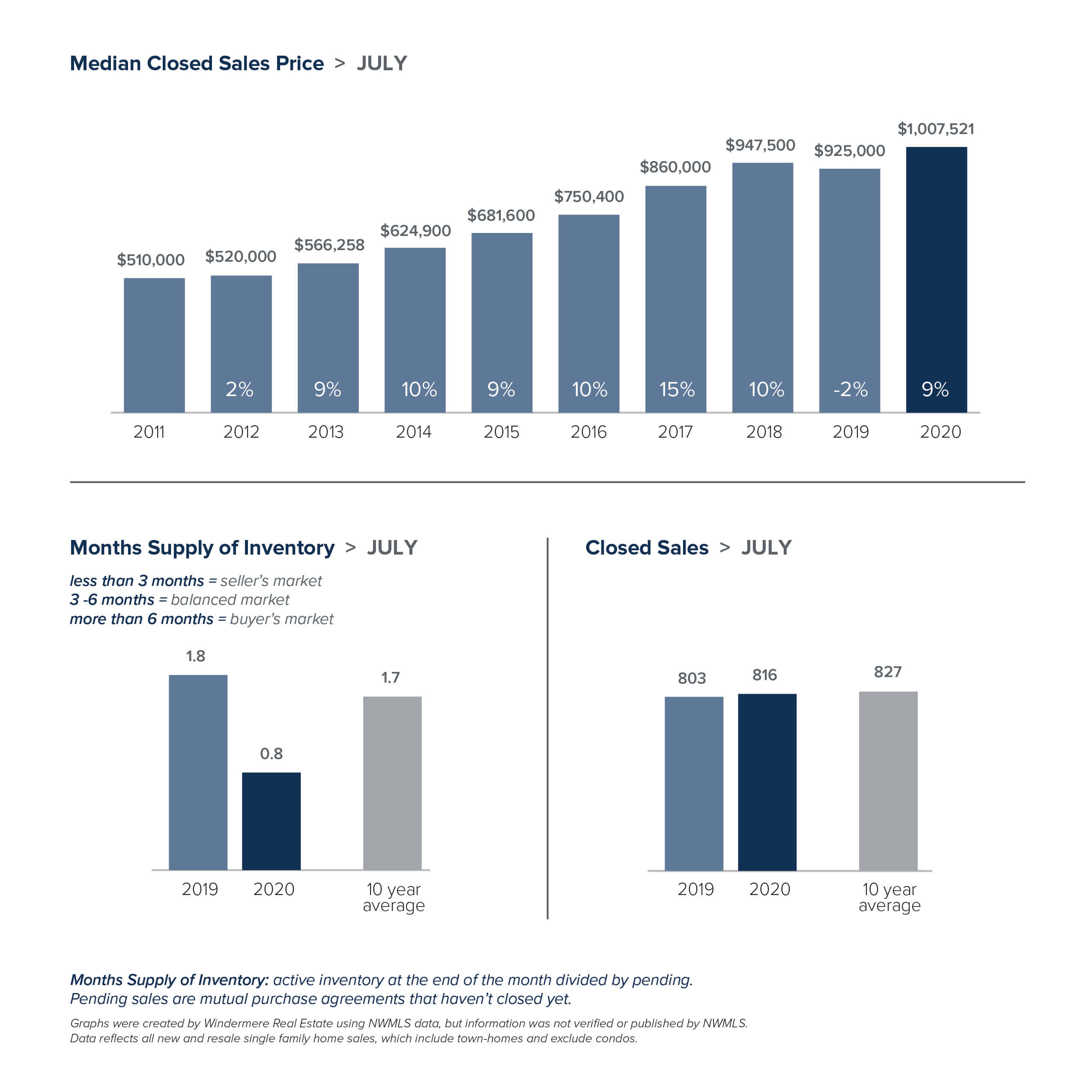

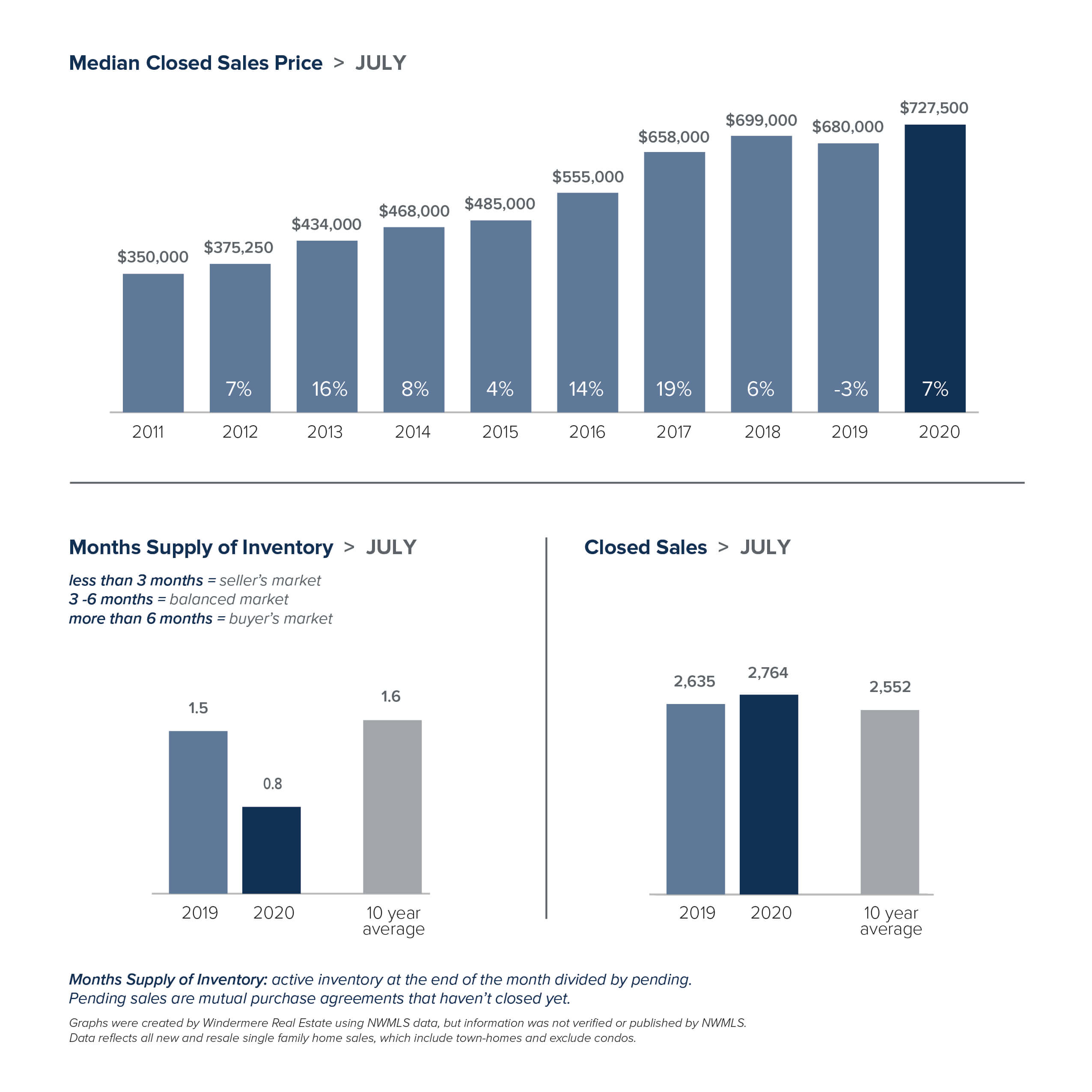

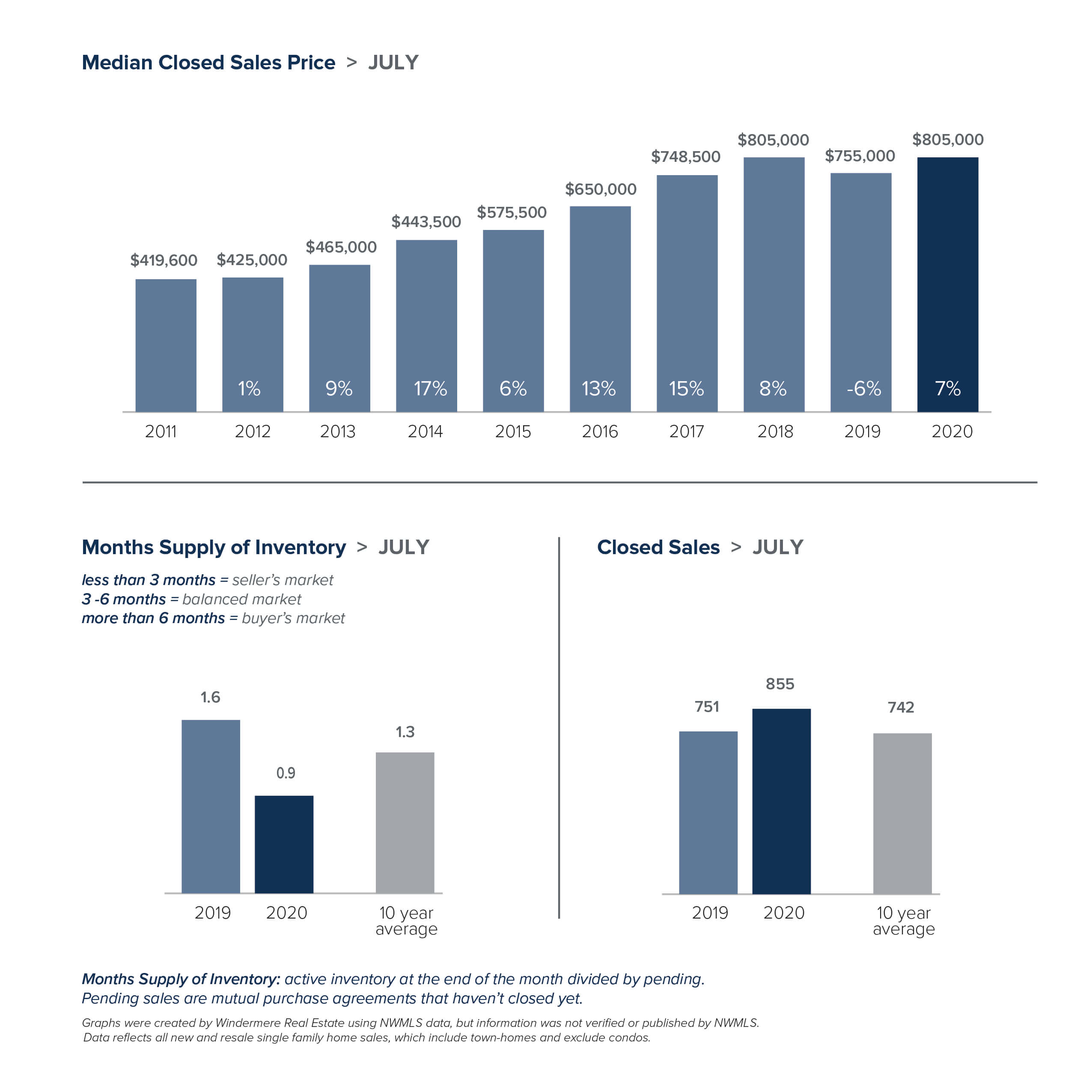

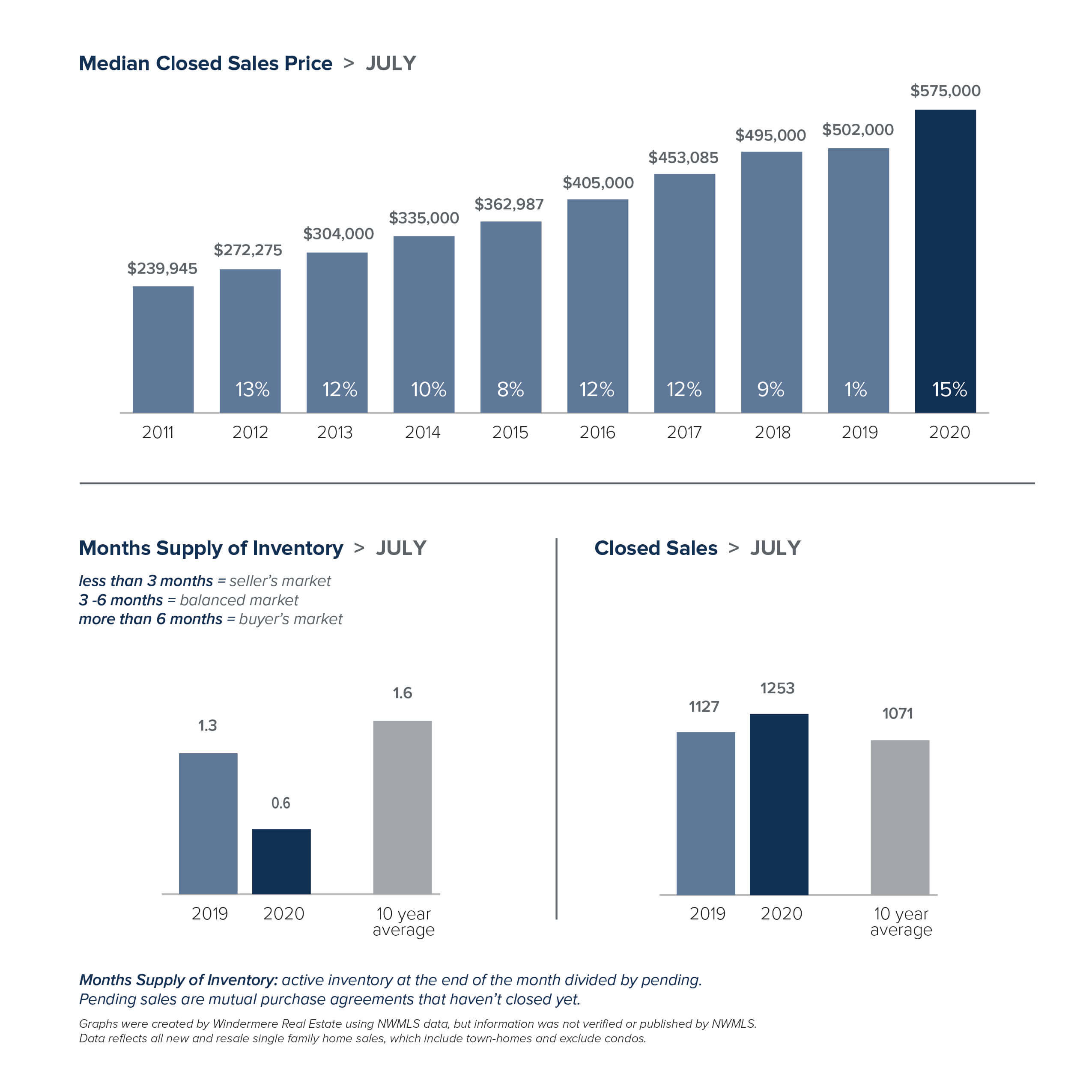

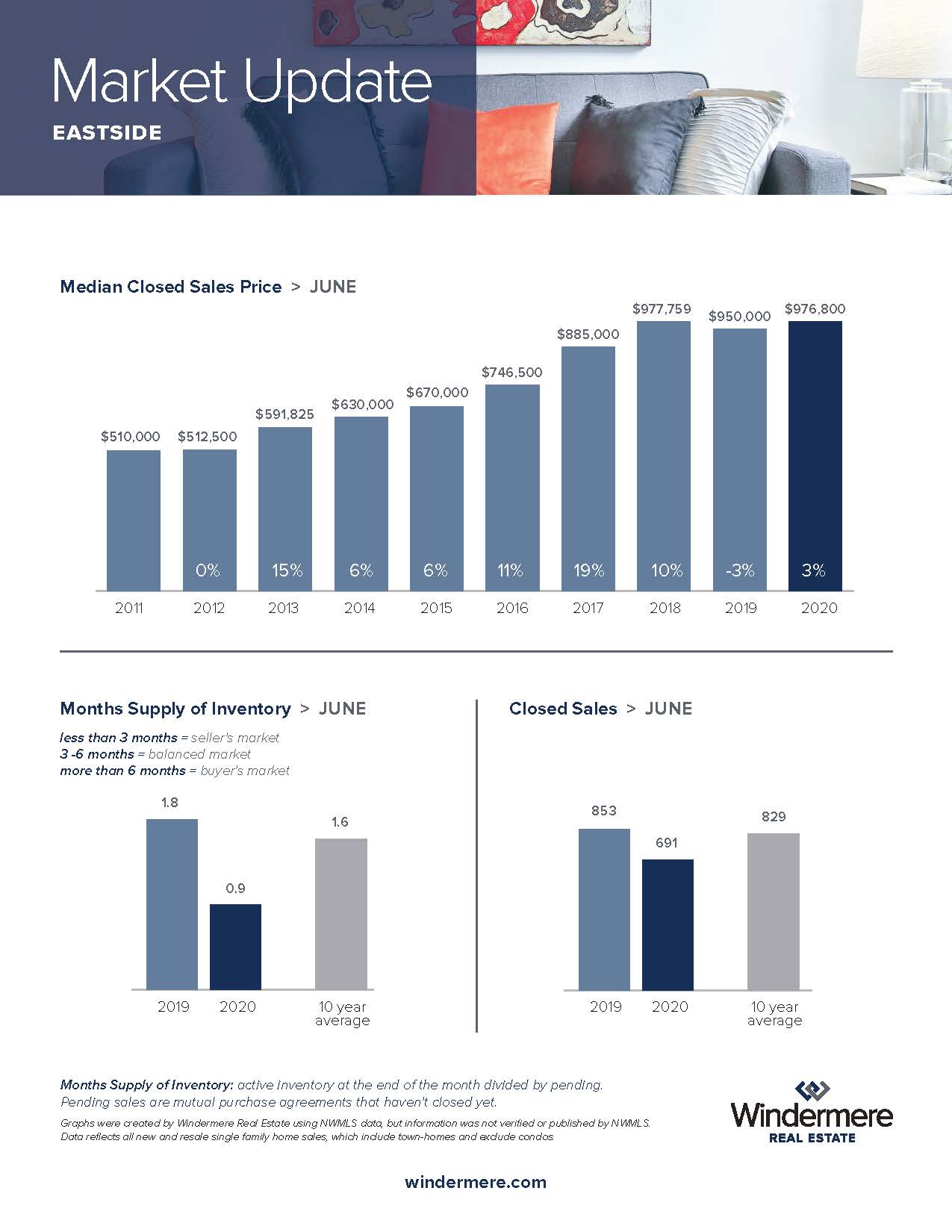

EASTSIDE

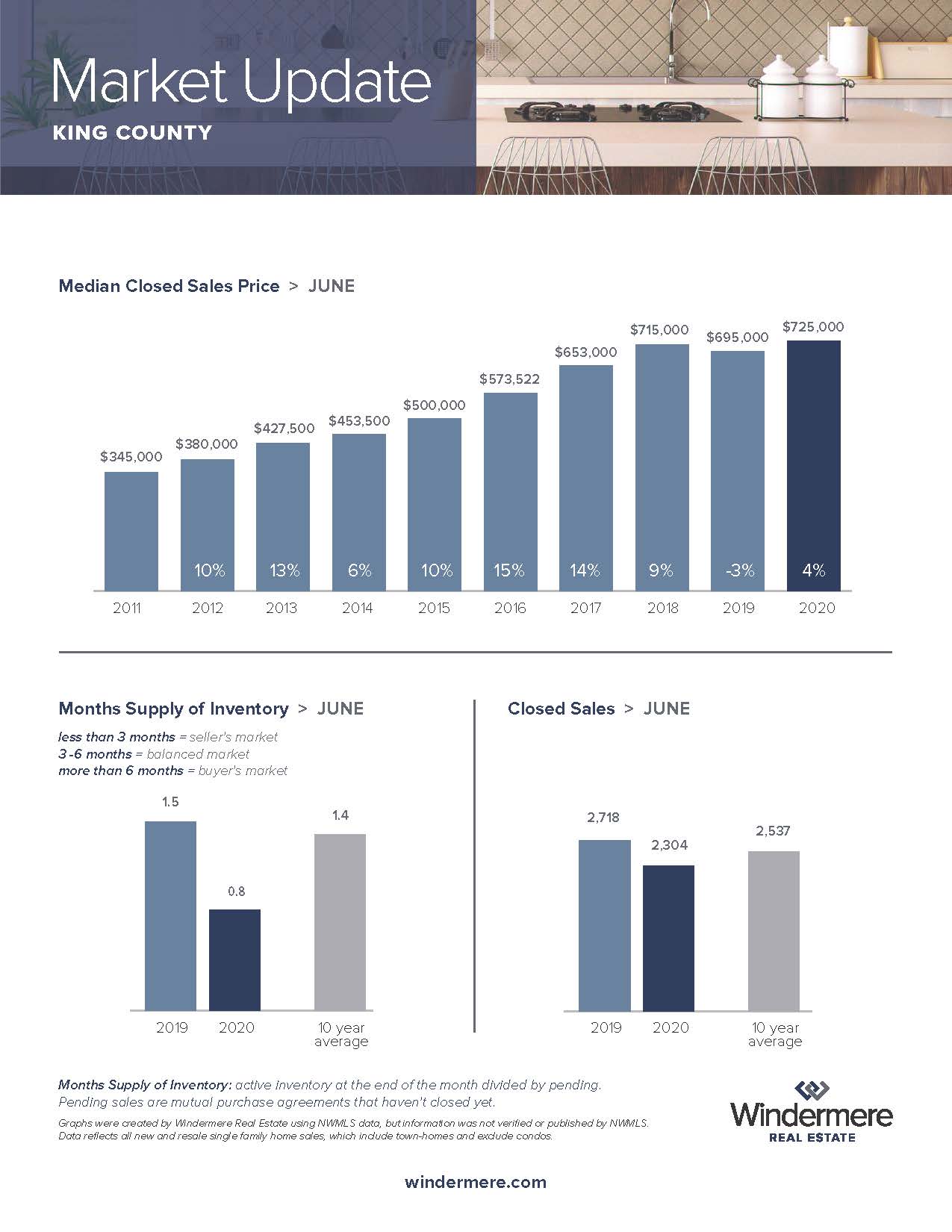

KING COUNTY

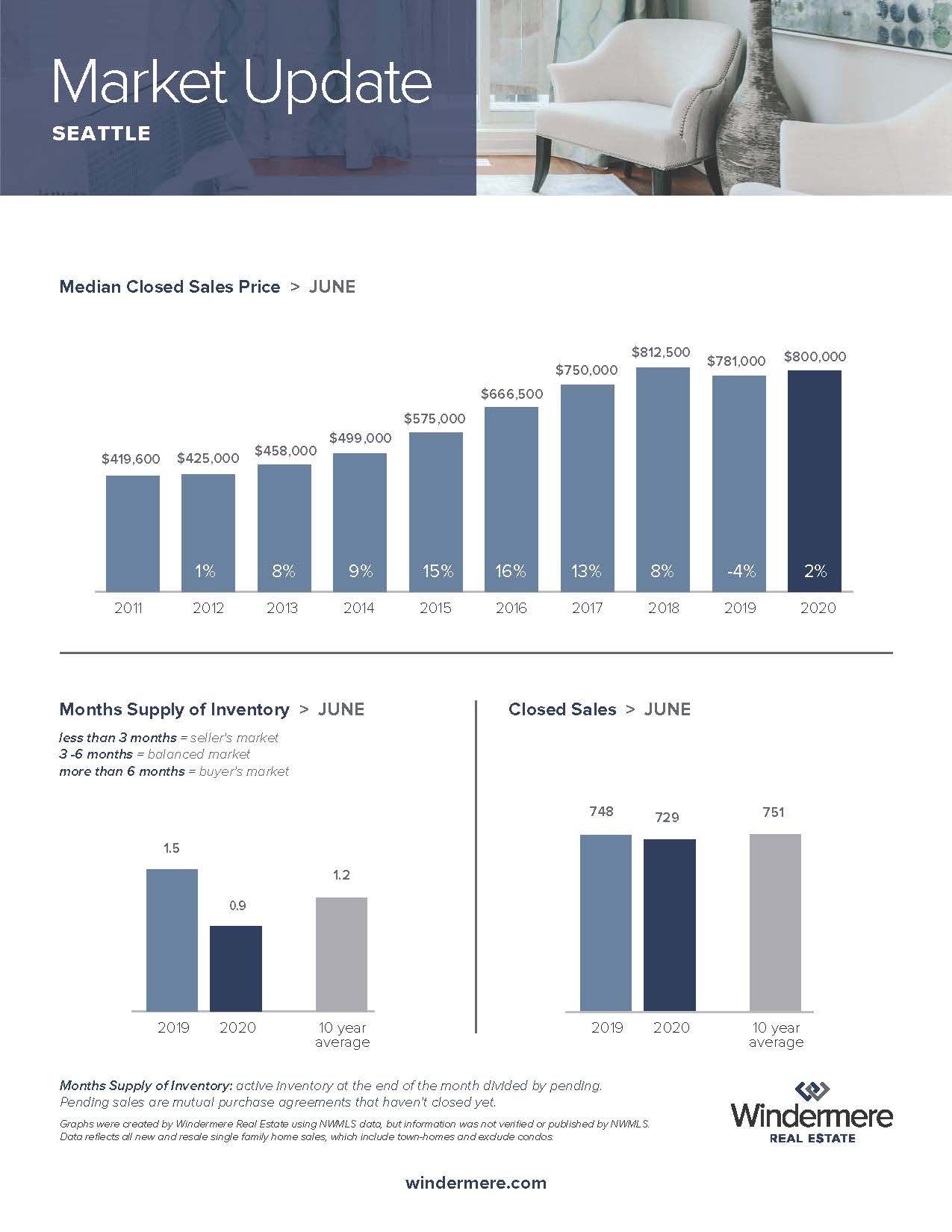

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com

A Remarkable Recovery for the Housing Market

For months now the vast majority of Americans have been asking the same question: When will the economy turn around? Many experts have been saying the housing market will lead the way to a recovery, and today we’re seeing signs of that coming to light. With record-low mortgage rates driving high demand from potential buyers, homes are being purchased at an accelerating pace, and it’s keeping the housing market and the economy moving.

Here’s a look at what a few of the experts have to say about today’s astonishing recovery. In more than one instance, it’s being noted as truly remarkable.

Ali Wolf, Chief Economist, Meyers Research

“The housing recovery has been nothing short of remarkable…The expectation was that housing would be crushed. It was—for about two months—and then it came roaring back.”

“Recent home purchase measures have continued to show remarkable strength, leading us to revise upward our home sales forecast, particularly over the third quarter. Similarly, we bumped up our expectations for home price growth and purchase mortgage originations.”

Javier Vivas, Director of Economic Research for realtor.com

“All-time low mortgage rates and easing job losses have boosted buyer confidence back to pre-pandemic levels.”

James Knightley, Chief International Economist, ING

“At face value this is remarkable given the scale of joblessness in the economy and the ongoing uncertainty relating to the path of Covid-19…The outlook for housing transactions, construction activity and employment in the sector is looking much better than what looked possible just a couple of months ago.”

Bottom Line

The strength of the housing market is a bright spark in the economy and leading the way to what is truly being called a remarkable recovery throughout this country. If you’re thinking of buying or selling a home, maybe this is your year to make a move after all.

Local Market Update – July 2020

While our lives are very different than they were a year ago, the local real estate market has recovered to 2019 levels. Record low interest rates are helping spur demand. Sales were up, home prices increased and multiple offers were common.

- The number of pending sales, a measure of current demand, was higher in June than for the same period a year ago.

- The supply of homes on the market remains very low, with just a month of available inventory. When inventory is this low, quick sales over full price are common. That was the case in June when about 40% of homes sold for more than the asking price.

- Home prices in King County rose 4% over a year ago. Snohomish County home prices increased 5%.

- More sellers put their homes on the market. While total inventory remains low, the number of new listings in June was similar to the same time last year.

The monthly statistics below are based on closed sales. Since closing generally takes 30 days, the statistics for June are mostly reflective of sales in May. If you are interested in more information, every Monday Windermere Chief Economist Matthew Gardner provides an update regarding the impact of COVID-19 on the US economy and housing market. You can get Matthew’s latest update here.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com

A Historic Rebound for the Housing Market

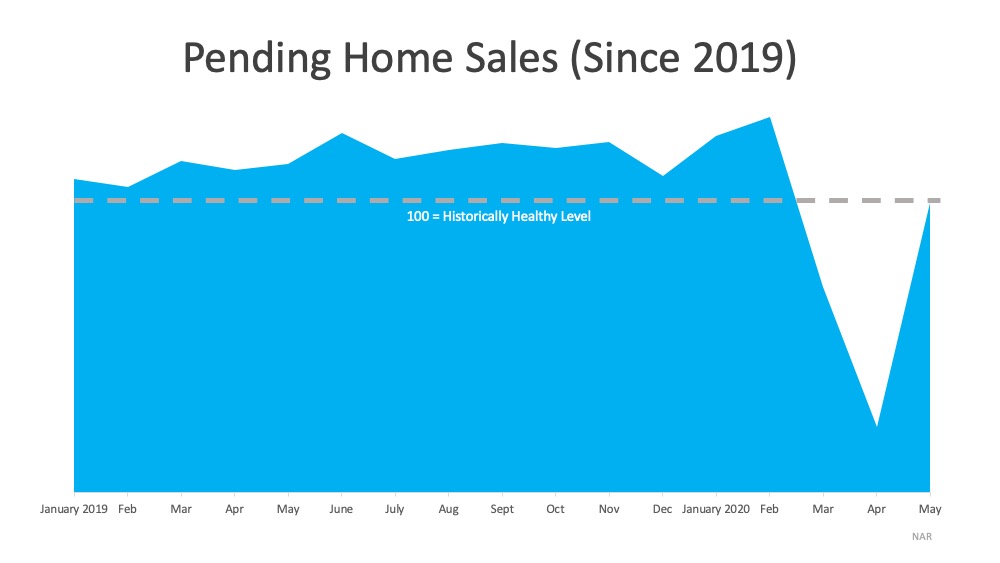

Pending Home Sales increased nationally by 44.3% in May, registering the highest month-over-month gain in the index since the National Association of Realtors (NAR) started tracking this metric in January 2001. So, what exactly are pending home sales, and why is this rebound so important?

According to NAR, the Pending Home Sales Index (PHS) is:

“A leading indicator of housing activity, measures housing contract activity, and is based on signed real estate contracts for existing single-family homes, condos, and co-ops. Because a home goes under contract a month or two before it is sold, the Pending Home Sales Index generally leads Existing-Home Sales by a month or two.”

In real estate, pending home sales is a key indicator in determining the strength of the housing market. As mentioned before, it measures how many existing homes went into contract in a specific month. When a buyer goes through the steps to purchase a home, the final one is the closing. On average, that happens about two months after the contract is signed, depending on how fast or slow the process takes in each state.

Why is this rebound important?

With the COVID-19 pandemic and a shutdown of the economy, we saw a steep two-month decline in the number of houses that went into contract. In May, however, that number increased dramatically (See graph below): This jump means buyers are back in the market and purchasing homes right now. Lawrence Yun, Chief Economist at NAR mentioned:

This jump means buyers are back in the market and purchasing homes right now. Lawrence Yun, Chief Economist at NAR mentioned:

“This has been a spectacular recovery for contract signings and goes to show the resiliency of American consumers and their evergreen desire for homeownership…This bounce back also speaks to how the housing sector could lead the way for a broader economic recovery.”

But in order to continue with this trend, we need more houses for sale on the market. Yun continues to say:

“More listings are continuously appearing as the economy reopens, helping with inventory choices…Still, more home construction is needed to counter the persistent underproduction of homes over the past decade.”

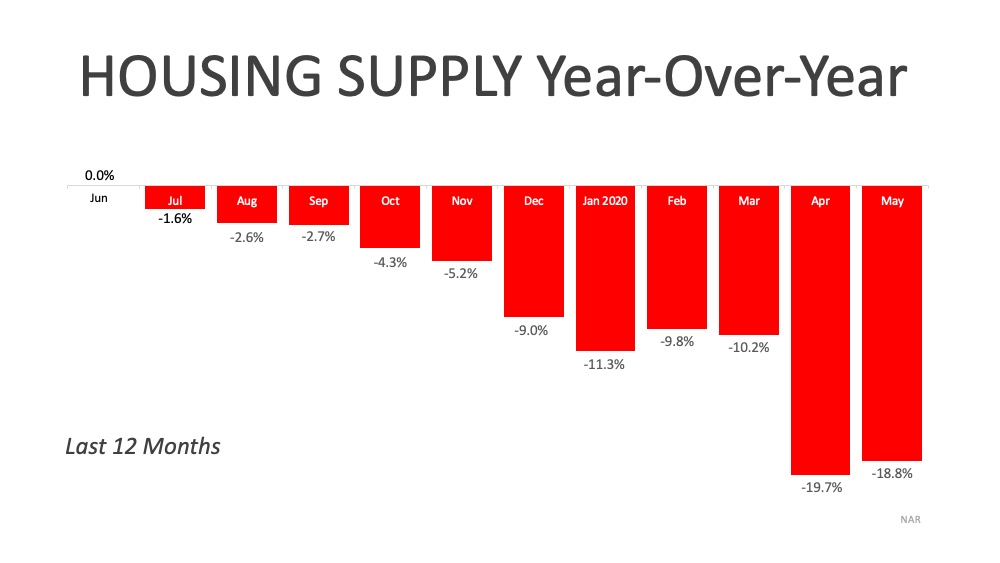

As we move through the year, we’ll see an increase in the number of houses being built. This will help combat a small portion of the inventory deficit. The lack of overall inventory, however, is still a challenge, and it is creating an opportunity for homeowners who are ready to sell. As the graph below shows, during the last 12 months, the supply of homes for sale has been decreasing year-over-year and is not keeping up with the demand from homebuyers.

Bottom Line

If you decided not to sell this spring due to the health crisis, maybe it’s time to jump back into the market while buyers are actively looking for homes. Let’s connect today to determine your best move forward.

Seattle Poised for Faster Recovery than Many Other Cities

It may feel like a tired refrain after nearly three months of quarantine, but it remains true: it’s still too early to truly tell the toll COVID-19 will take on our economy — both locally and nationally — until we are able to fully reopen and jumpstart area businesses.

Thanks to our diversified economy, strong tech sector and attractive, startup-friendly environment, the Seattle area is well-positioned for and capable of a nimble recovery.

Several recent studies analyzing our housing market, population density, and educational attainment (and jobs that require higher education) indicate that Seattle is primed for a recovery that may be quicker and shorter than other major metropolitan areas across the country.

ATTOM Data Solutions, a provider of real estate and property data, put together a special report comparing regions across the country and identifying the housing markets more and less vulnerable to COVID-19 impacts. Their research puts King County within the 50 least at-risk counties. Furthermore, their data shows the West Coast as a whole to be incredibly resilient, with only one West Coast county (in California) appearing in the top 50 most vulnerable markets.

Looking at population density and education, Moody’s Analytics assessed the 100 top metro areas in the country and identified the U.S. cities in the best and worst positions for post-pandemic recovery. Their research notes that the cities best prepared to bounce back have low population densities and high levels of educational attainment. Seattle ranked in the top five metros poised for a quick recovery.

While the recent economic contraction has been profound and carried many unseen ramifications, our region’s tech sector has remained strong. Dominating much of our local economy, tech’s presence here may help buffer our area’s economy from worse dips taking place elsewhere.

It is true that some sectors of our regional economy — particularly hospitality (restaurants and bars), leisure (hotels), tourism and travel — have been hit harder. Those businesses and employees feel the impacts more strongly and may experience a harder and more drawn-out recovery. The direct hits to these sectors — with shuttered businesses and job losses — will resonate through the economy at large. As noted by Windermere Chief Economist Matthew Gardner in a recent “Mondays with Matthew” post looking at how COVID-19 has affected employment, it’s likely that many workers in these sectors are renters, so their misfortunes are likely to impact the region’s rental market. As businesses are forced to close, many may struggle to find new employment until the economy is open and fully operational again.

Loss of tax revenue from the retail, hospitality and tourism sectors (especially from cruise ships, many of which will not be docking in Seattle for the foreseeable future), is already impacting state and local budgets, potentially causing painful future spending cuts over the next few years, as noted in The Seattle Times.

While our economy — city, state, and national — has shrunk dramatically in the second quarter of this year, economists still anticipate recovery beginning as soon as businesses reopen, and stay-at-home orders are lifted. Gains will advance slowly, but will continually increase through the remainder of the year. As Matthew Gardner predicts, the second half of 2020 should be significantly better than the first.

This post originally appeared on GettheWReport.com

Windermere Insights: How COVID-19 is really impacting local real estate

The challenges presented by COVID-19 have been felt locally by every home buyer, seller and real estate broker. Residential real estate, which was moving at breakneck speed through February, came to a screeching halt for two weeks in March after the initial Stay Home order was implemented.

As soon as Governor Inslee declared real estate an essential business, the engines started to rev again. Despite job losses and a nosedive in general consumer confidence and spending, home buyers started to jump back into the market. Theories abound about why this could happen in the middle of a pandemic:

- With some exceptions, our local tech sector has generally performed well during COVID-19 and its employees may feel reasonably insulated from the worst of the economic fallout. For some, their stock options may have actually increased in value during the worst of the coronavirus.

- Many buyers were already feeling the squeeze of low housing inventory and the defeat of losing out in multiple-offer situations. Some likely saw the lower competition during the shutdown as an opportunity to finally gain a foothold.

- Mortgage rates in the early stages of the shutdown dropped to historic lows, with some 30-year fixed loans carrying percentage rates in the low threes.

- Renters and homeowners with sustained income security found themselves suddenly doing everything from home – working, schooling, exercising – which may have motivated them to pursue a change in space, moving from dreamers to active buyers.

- Lots of real estate “window shoppers” suddenly had a lot more time on their hands and spent hours perusing eye-candy listings online and watching more HGTV than ever, accelerating their property lust and their entry into the buyer pool.

Some of these theories have metrics behind them and some remain just theories. Regardless of the motivation, buyers are back “out” in force, touring prospective homes online, via livestream video with a broker or pre-produced 3D tours and videos. Brokers are showing them homes in person too – while following many safety precautions. Because of this strong buyer interest, prospective sellers are hearing from their brokers that now may be a good time to list.

For weeks now, we have seen multiple offers on homes in popular neighborhoods. Brokers, for whom business was put on hold at the end of March, are as busy as at any other point this year. Though the new normal is still not completely normal, the market in many neighborhoods and price points seems to be skipping along as if it were.

To learn how various sectors of our local real estate market are performing during COVID-19, we asked Windermere experts from Seattle and the Eastside what they are seeing.

Real Estate Across Seattle

Laura Smith, co-owner and principal broker of Windermere Real Estate Co., which operates multiple real estate offices in Seattle, has been busy helping brokers ramp up quickly and navigate a hefty transaction load along with new protocols for listing and showing homes. “It’s been a total whirlwind,” she said. “The market went from zero to sixty in a heartbeat.”

Smith explained that out of nine MLS areas in the city of Seattle, seven had less housing stock (measured as months of inventory) than what was available in May 2019, and the other two areas had the same inventory levels as last year. She noted that Seattle’s pending home sales during Week 3 of May already had reached 95% of the transaction count from the same week in 2019.

“Right now buyers want in,” Smith said, “and inventory numbers favor sellers.” Prices, as a result, have “stayed strong,” according to Smith, even in the midst of a health-related shutdown.

Bouncing Back on the Eastside

According to Matt Deasy, President of Windermere Real Estate / East, Inc., the volume of business has bounced back quicker than expected and brokers are busy helping buyers and sellers while following new practices to prevent the spread of the coronavirus.

“After reentering the market, buyers are finding the competition as fierce as it was before COVID-19,” Deasy said. His analysis shows that while Eastside pending sales are still down from a year ago, by Week 2 of May they were at 73% of last year’s figure from the same week. “Each week we are seeing the market steadily catch up to last year,” Deasy observed, “and I think it will soon head north of 2019 weekly transaction yields.”

Deasy pointed out that low Eastside housing supply is a challenge for buyers rushing back in to the market. “There is so little for sale” he said, noting that of the Eastside’s eight MLS areas, all but one had extremely low levels of inventory. “In fact,” Deasy continued, “three Eastside areas have a month or less supply of homes.” As a result, he predicts that “prices in popular neighborhoods will continue to climb” for the foreseeable future.

The Luxury Market

Patrick Chinn, owner of Windermere Real Estate Midtown, regularly works with luxury brokers and their clients. He observed that the luxury market was proceeding at a seasonally appropriate pace prior to the shutdown but has appeared a little slower to come back online as restrictions on real estate lifted. “Luxury sellers are typically not in a rush,” Chinn noted, “and the safety considerations of listing a home during COVID-19 may have delayed” their entry into the market.

Due to their high net worth, luxury buyers on the other hand may have been “less adversely impacted by the very real economic impacts of the shutdown,” Chinn said. But he also observed that fluctuations in the stock market usually make for “a restless luxury market, despite greater potential access to capital.” Chinn expects the pace of new high-end transactions and inventory to remain below what it was pre-shutdown, at least until there’s a clearer economic picture in sight.

Chinn did note that if a singular property is listed during an economic downturn such as the one we now find ourselves in, there can still be great urgency by luxury buyers to purchase. He gave as an example a Medina property listed during the topsy-turvy days just before the shutdown that quickly went under contract at its asking price of $11.75 million. “Iconic homes on iconic streets will still generate lots of enthusiasm, even during a downturn,” Chinn said.

He reported that one of his brokers went full speed ahead to list a one-of-a-kind beachfront property in Magnolia. Even during the lingering impacts of COVID-19, “there’s no time like the present for listing incredible homes,” Chinn explained.

Continuing New Construction

Joe Deasy, co-owner of Windermere Real Estate / East Inc., says that the early phase of the shutdown created significant waves for residential builders. Initially both the building and listing/showing of all residential new construction projects were stopped due to the Stay Home order.

As builders start building again and brokers start showing finished units, “the early pace will naturally be a bit slower,” Deasy said. He explained this as a result of builders needing to rehire furloughed workers and buyers’ agents implementing safety measures to prevent the spread of the coronavirus.

“I expect things to accelerate pretty quickly as we move forward,” Deasy predicted. His reason? “There’s so little inventory out there, both new construction and resale,” he explained. “The product that is available looks pretty attractive right now, since it’s brand new and no one’s ever lived in it.”

Deasy remains positive about the region’s new construction market. He pointed out that leading into the Stay Home closure, Windermere’s King County new construction business was through the proverbial roof. “Even factoring in the shutdown, our year-to-date unit sales are up 41% over last year,” he noted, “and our sales volume is already at $700 million.”

Looking ahead, Deasy predicts that demand for new construction homes will remain strong and that supply will have the biggest impact on the sector’s overall market performance. “Low inventory may influence 2020 sales more than the shutdown,” he explained, “which, all things considered, was relatively brief.”

This post originally appeared on GettheWReport.com

Local Market Update – May 2020

We hope you are weathering the new normal as best as you can. With everyone spending more time than ever at home, real estate has taken on a whole new importance. For those who are interested, here is a brief update on how COVID-19 continues to affect our local market:

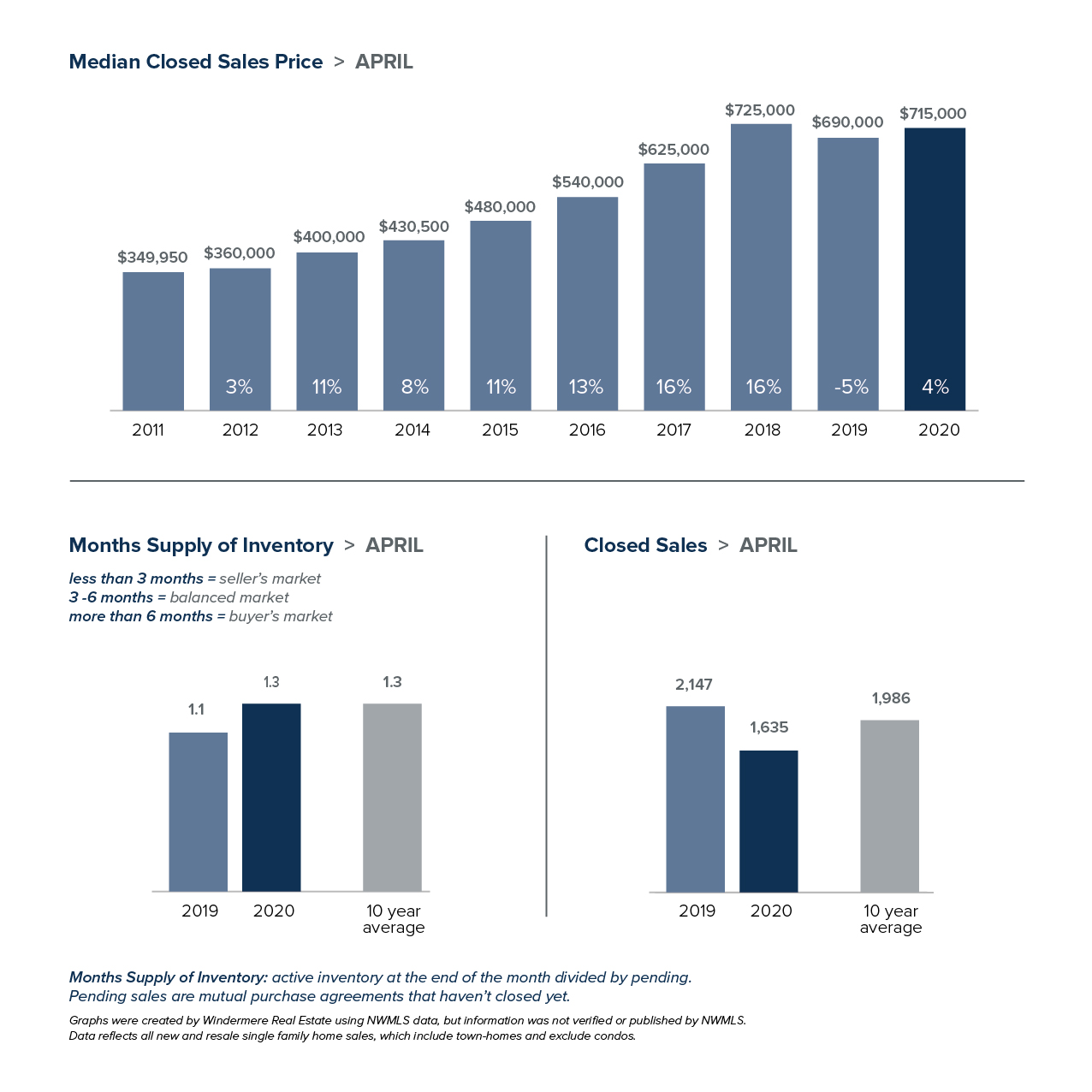

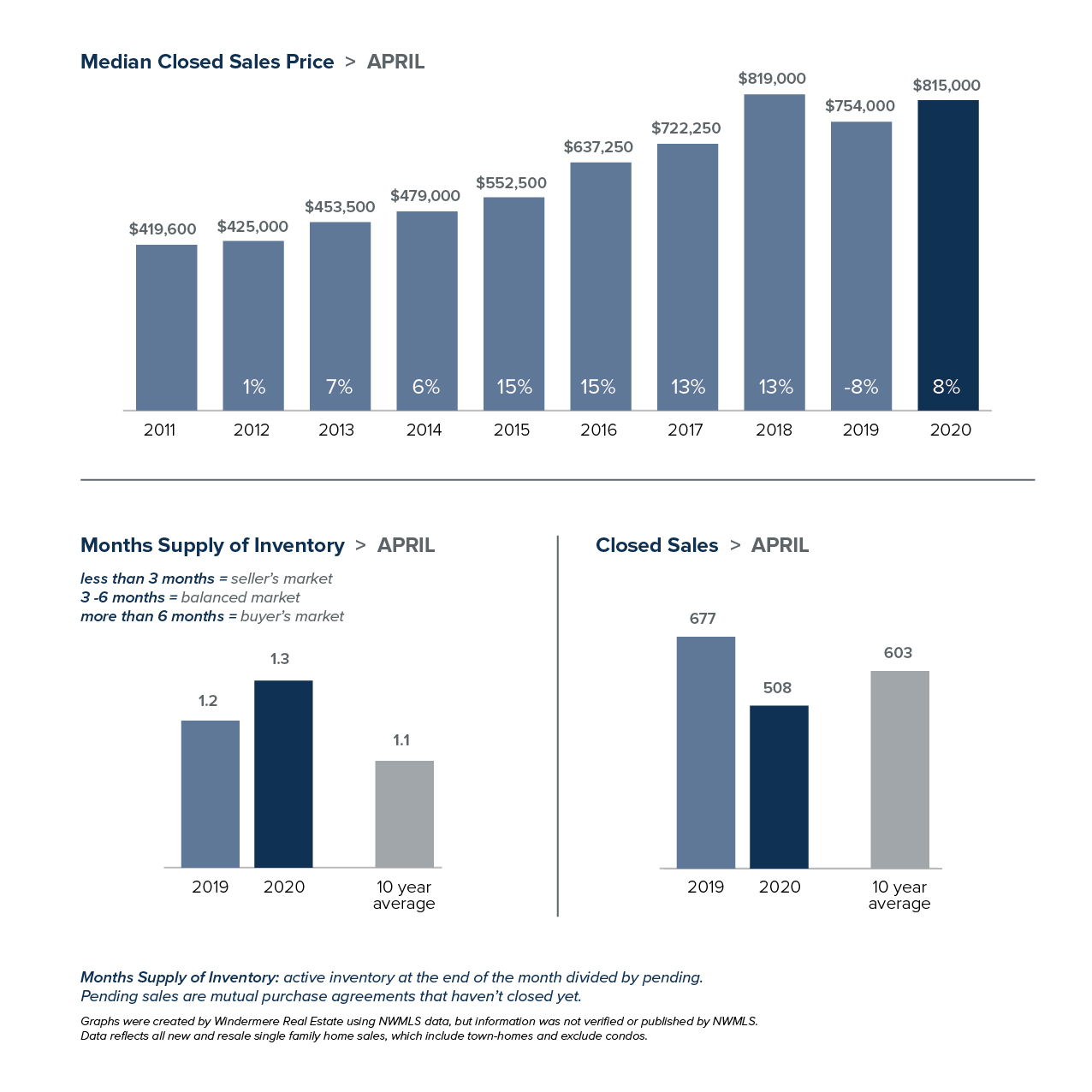

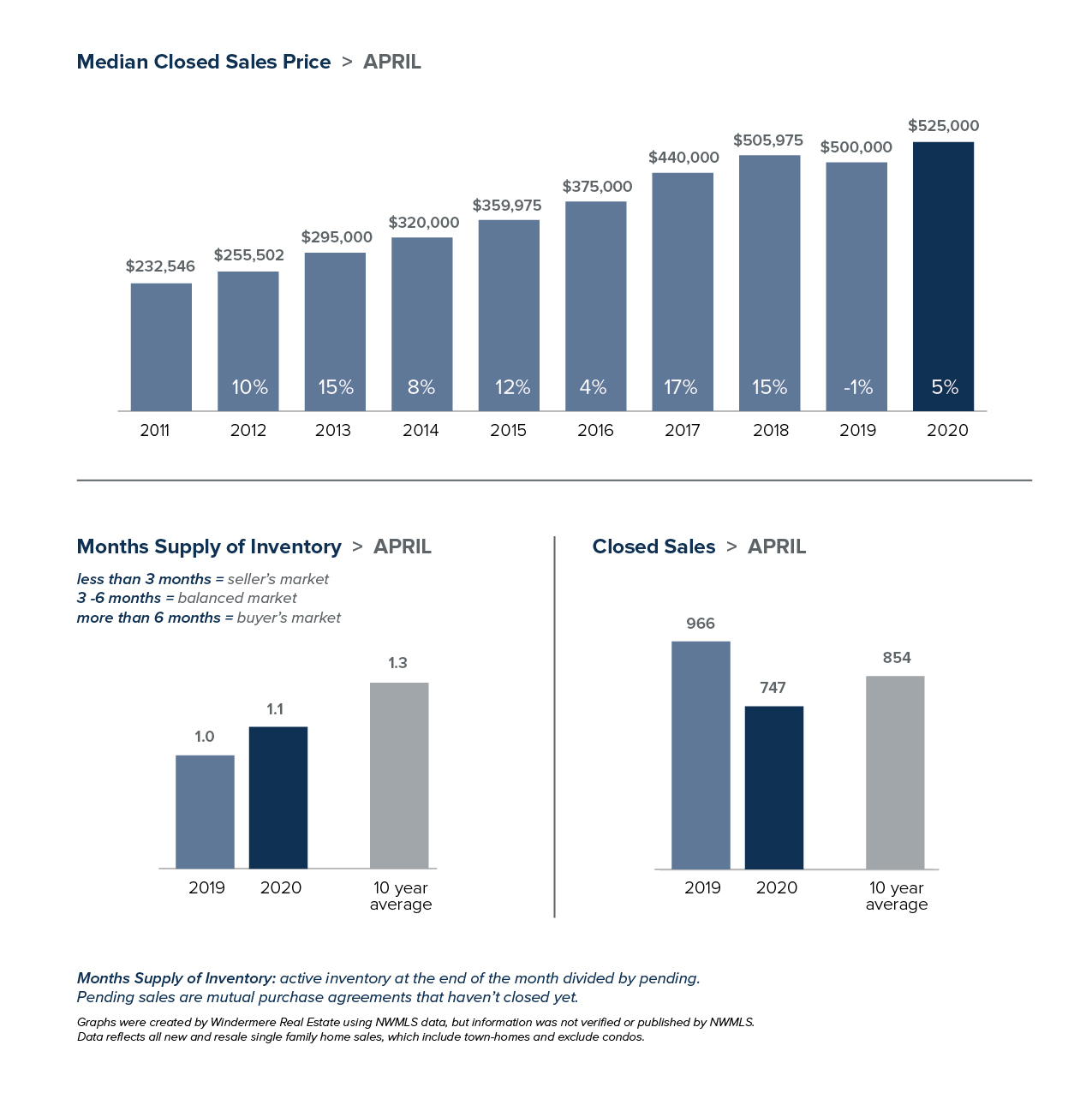

- Business was better than expected under the Stay Home order. COVID-19 did reduce real estate sales in April as compared to a year ago, however the number of sales rose steadily each week of the month. Sales growth continued in early May and we expect sales to increase slowly week by week.

- The number of new listings dropped, suggesting that would-be sellers are waiting until the shelter-in-place order is over to put their home on the market. With local technology companies continuing to hire, buyers will continue to face competition for limited inventory in the coming months.

- Home prices remain stable, with the median price of homes sold in April up slightly from a year ago. Sellers appear to be pricing homes realistically and buyers are not finding deep discounts.

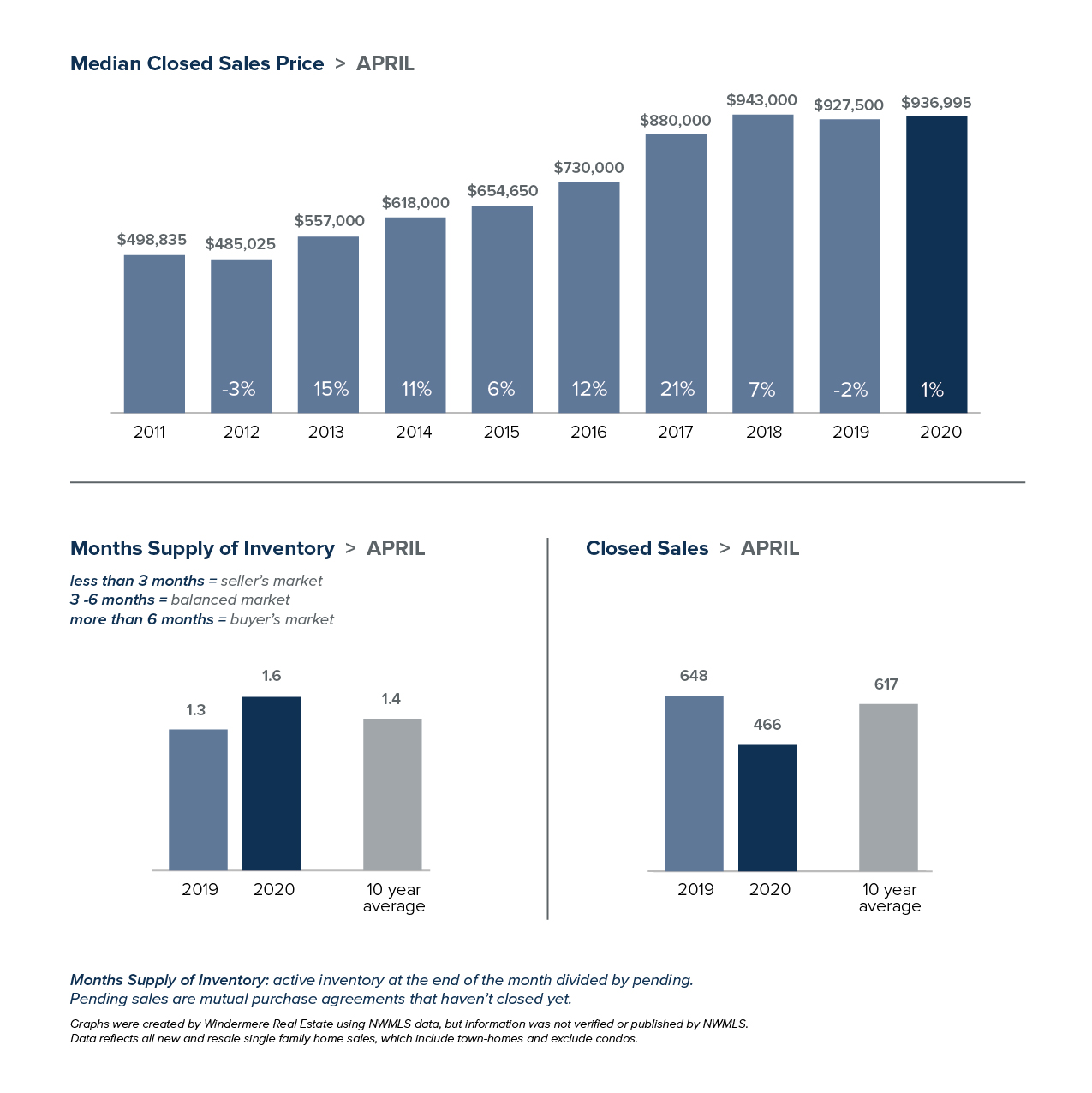

The monthly statistics below are based on closed sales. Since closing generally takes 30 days, the statistics for April are mostly reflective of sales in March. Next month’s data will offer a more telling trend of the effect of the virus on the local housing market.

If you are interested in more information, every Monday Windermere Chief Economist Matthew Gardner provides an update regarding the impact of COVID-19 on the US economy and housing market. You can get Matthew’s latest update here.

As our current situation evolves, know that the safety of everyone remains our top priority.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link